This is reinforced by a comfortable financial leverage, represented by the ratio of financial debt to equity (at 1.30 as of September 30th 2025) and by an adequate operating leverage expressed as the ratio of financial debt to EBITDA (at 1.86 as of December 31st 2024).

Financial profile

The financial structure of the Piaggio Group is marked by the availability of a large portion of undrawn committed credit lines. This allows Piaggio to maintain a comfortable margin of 'potential' debt to cope with the planned needs, generated, among other things, by the natural maturities of the debt incurred as well as any temporary unexpected needs.

Financing always aims at obtaining the most economically convenient conditions and optimizing the maturity profile.

The Group also systematically manages financial risks: in particular, exchange rate risk is managed through the use of special derivative instruments based on defined internal policies The risk of interest rate changes is managed structurally by adjusting fixed and floating rate debt and tactically, through derivative contracts.

Composition of debt at 09/30/2025

During the first nine months of 2025, the Group's total debt went up by €/000 4,080. Net of the change in financial liabilities for rights of use, the Group’s total financial debt increased by €/000 10,881 as of 30 September 2025.

Net financial debt of the Group amounted to €/000 528,153 as of 30 September 2025 compared to €/000 533,973 as of 31 December 2024.

Covenant

The Group credit facilities and loans are unsecured. Certain medium term facilities include financial covenants in line with market practice for borrowers with similar credit standing.

The financial covenants calculated based on the most recent relevant financial statements have fully satisfied the thresholds required.

Maturities of Piaggio Group financial liabilities as at 30 September 2025

| (in thousand euros) | 2025 | 2026 | 2027 | 2028 | 2029 | Beyond | |

|---|---|---|---|---|---|---|---|

| Loans | 344,018 | 9,238 | 107,763 | 81,747 | 40,183 | 63,583 | 41,504 |

| Bonds | 250,000 | 0 | 0 | 0 | 0 | 250,000 | |

| Amounts due to other lenders | 71 | 35 | 36 | 0 | 0 | 0 | 0 |

| Medium term financial liabilities total | 594,089 | 9,273 | 107,799 | 81,747 | 40,183 | 63,583 | 291,504 |

| Short term financial liabilities | 78,844 | 78,844 | |||||

| Financial liabilities total (short and medium term) | 672,933 | 88,117 | 107,799 | 81,747 | 40,183 | 63,583 | 291,504 |

| Undrawn committed credit lines | 235,000 | 24,650 |

The main financial risks the Group is exposed to are exchange rate risk and interest rate risk.

The management of these risks is centralised and treasury operations take place in accordance with formal policies and guidelines which are applicable to all Group companies.

Exchange Risk

The Group operates in an international context where transactions are conducted in currencies different from Euro. This exposes the Group to risks arising from exchange rates fluctuations. The existing exchange risk management policy aims to neutralise the possible negative effects of the changes in exchange rates on company cash-flows.

This policy analyses:

The exchange risk

The policy wholly covers this risk which arises from differences between the recognition exchange rate of receivables or payables in foreign currency in the financial statements and the recognition exchange rate of actual collection or payment. To cover this type of exchange risk, the exposure is naturally offset in the first place (netting between sales and purchases in the same currency) and if necessary, by signing currency future derivatives, as well as advances of receivables denominated in currency.

The settlement exchange risk

Arises from the conversion into euro of the financial statements of subsidiaries prepared in currencies other than the euro during consolidation. The policy adopted by the Group does not require this type of exposure to be covered.

The business risk

Arises from changes in company profitability in relation to annual figures planned in the economic budget on the basis of a reference change (the "budget change") and is covered by derivatives. The items of these hedging operations are therefore represented by foreign costs and revenues forecast by the sales and purchases budget. The total of forecast costs and revenues is processed monthly and relative hedging is positioned exactly on the average weighted date of the economic event, recalculated based on historical criteria. The economic occurrence of future receivables and payables will occur during the budget year.

Interest rate risk

This risk arises from fluctuating interest rates and the impact this may have on future cash flows arising from financial assets and liabilities. The Group regularly measures and controls its exposure to interest rates changes and manages such risks also resorting to derivative instruments, mainly Interest Rate Swaps and Cross Currency Swaps, as established by its own management policies.

Cash flows and the Group’s credit line needs are managed in order to guarantee:

- an effective and efficient management of the financial resources

- the optimisation of debt’s maturity standpoint

The liquidity risk arises from the possibility that available financial resources are not sufficient to cover, in due times and procedures, future payments arising from financial and/or commercial obligations. To deal with these risks, cash flows and the Group’s credit line needs are monitored or managed centrally under the control of the Group’s Treasury in order to guarantee an effective and efficient management of the financial resources as well as optimise the debt’s maturity standpoint.

In addition, the Parent Company finances the temporary cash requirements of Group companies by providing direct short-term loans regulated in market conditions or guarantees.

As of 30 September 2025, the Group had a liquidity of €/000 157,233, undrawn irrevocable credit lines of €/000 259,650 and revocable credit lines of €/000 202,057, as detailed below:

| In thousands of Euros | As of 30 September 2025 | As of 31 December 2024 |

|---|---|---|

| Variable rate with maturity within one year - irrevocable until maturity* | ||

| Variable rate with maturity beyond one year - irrevocable until maturity | 259,650 | 265,500 |

| Variable rate with maturity within one year - cash revocable | 202,057 | 213,471 |

| Variable rate with maturity within one year - with revocation for self-liquidating typologies | ||

| Total undrawn credit lines | 461,707 | 478,971 |

*Does not take into account the 1-year extension on the revolving credit facility of the syndicated loan.

|

Issuer |

Listing |

ISIN |

Par |

Rating |

Rating |

Duration |

Maturity |

Coupon |

Interest rate |

|---|---|---|---|---|---|---|---|---|---|

|

Piaggio & C. S.p.A. |

Luxembourg |

XS2696224315 |

250 mln € |

BB- |

Ba3 |

7 years |

05/10/2030 |

half-yearly |

6,5% |

Notice: This section of the website was set up to facilitate access to information regarding Piaggio Group bond issues. The offer documents and information, the listing prospectuses of the bonds, the prospectuses on the Issuer, and regulations and notices relating to the financial instruments are subject to publication in accordance with prevailing law. In particular, the financial reports required by the Regulations are published on the website in the "Company Documentation” section. None of the financial instruments described in the prospectuses is subject to offer or sale by the Group companies.

Piaggio's official rating was assigned by two of the largest specialized rating agencies, Standard and Poor’s and Moody’s Investor Service, in the sub-investment grade category.

Standard & Poor's

| Corporate | BB- |

|---|---|

| Outlook | Negative |

| Date of assigment | 7 August 2025 |

Moody's

| Corporate | Ba3 |

|---|---|

| Outlook | Stable |

| Date of assigment | 25 September 2023 |

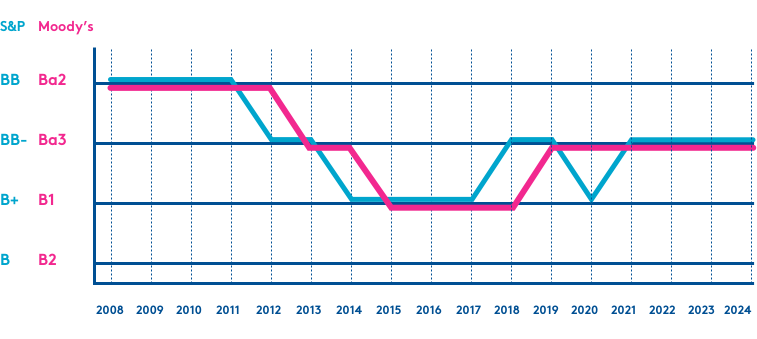

Historical ratings

Comparison of the Standard & Poor’s and Moody’s ratings

| INVESTMENT GRADE | NON INVESTMENT GRADE | ||

|---|---|---|---|

| S&P | MOODY’S | S&P | MOODY’S |

| AAA | Aaa | BB+ | Ba1 |

| AA+ | Aa1 | BB | Ba2 |

| AA | Aa2 | BB- | Ba3 |

| AA- | Aa3 | B+ | B1 |

| A+ | A1 | B | B2 |

| A | A2 | B- | B3 |

| A- | A3 | CCC+ | Caa1 |

| BBB+ | Baa1 | CCC | Caa2 |

| BBB | Baa2 | CCC- | Caa3 |

| BBB- | Baa3 | CC | CA |

| C | C | ||

| D | |||

WARNING

Ratings do not represent advice to buy, sell or hold Piaggio Group financial instruments of any nature. Since the ratings above can be subject to change, replacement, suspension or withdrawal, the website visitor is required to check the long term rating, short term rating and current outlook.

The Group’s financial structure reflects a policy which is alert to market opportunities and has a prudent allocation of resources as well as careful about refinancing risk. This is reinforced by a comfortable financial leverage, represented by the ratio of financial debt to equity (at 1.30 as of September 30th 2025) and by an adequate operating leverage expressed as the ratio of financial debt to EBITDA (at 1.86 as of December 31st 2024).

Debt Key ratios

| YEARLY KEY RATIO |

31/12/2024 | 31/12/2023 | 31/12/2022 | 31/12/2021 | 31/12/2020 | 31/12/2019 | 31/12/2018 | 31/12/2017 | 31/12/2016 | 31/12/2015 |

|---|---|---|---|---|---|---|---|---|---|---|

| Net Debt / EBITDA | 1.86 | 1.34 | 1.24 | 1.58 | 2.28 | 1.89 | 2.13 | 2.32 | 2.88 | 3.04 |

| QUARTERLY KEY RATIO |

30/09/2025 | 31/06/2025 | 31/03/2025 | 31/12/2024 | 30/09/2024 | 30/06/2024 | 31/03/2024 | 31/12/2023 | 30/09/2023 | 30/06/2023 | 31/03/2023 | 31/12/2022 | 30/09/2022 | 30/06/2022 | 31/03/2022 | 31/12/2021 | 30/09/2021 | 30/06/2021 | 31/03/2021 | 31/12/2020 | 30/09/2020 | 30/06/2020 | 31/03/2020 | 31/12/2019 | 30/09/2019 | 30/06/2019 | 31/03/2019 | 31/12/2018 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Debt / Equity | 1.30 | 1.31 | 1.41 | 1.28 | 1.13 | 0.92 | 1.14 | 1.04 | 0.93 | 0.88 | 0.97 | 0.88 | 0.89 | 0.94 | 1.06 | 0.94 | 0.95 | 0.98 | 1.15 | 1.14 | 1.15 | 1.44 | 1.42 | 1.12 | 1.05 | 1.06 | 1.18 | 1.10 |